The pandemic is seen by many as the root cause of the silicon shortage, but there have been issues in the industry for far longer. The pandemic has been the catalyst that made these issues worse sooner.

Based on my recent research as part of a supply chain management course at the London School of Economics, I’ll go over what is plaguing the semiconductor industry today and what that means going forward.

This is Part 2 in my semiconductor series. If you’re not familiar with the semiconductor industry feel free to read Part 1: Understanding the semiconductor industry for a brief overview.

Let’s start by assessing the impact of the COVID-19 pandemic on the relevant supply chains. Developments in demand were the main drivers in the development of strains and shortages in the supply chain: (1) increased demand and (2) demand uncertainty.

Increased demand

Firstly, strain was put on the supply chain because of increased demand. Government policies to limit the spread of COVID-19 were put in place at various times in the pandemic. Lockdowns and other forms of ‘stay-at-home orders’ occurred globally and restricted large swaths of the population to the confines of their homes. There are two key streams of demand-driving behaviour changes. On the one hand, there is the necessity to work and study remotely. As companies and institutions moved online, end users saw a greater need for peripherals, such as keyboards, mice, and monitors, as well as personal computers for those who previously did not need them (Stewart & Crossan, 2022).

On the other hand, entertainment (and its related spending) moved entirely online. Being limited to online entertainment caused an increased demand for game consoles, PC parts, and other consumer electronics (Warneke et al., 2021). Both streams of increased demand directly required more semiconductors as nearly all devices contain at least some processing power today (Santacreu & Labelle, 2022).

Demand uncertainty

Secondly, demand uncertainty led companies to reduce forecasts and cancel orders in anticipation of a recession, leading to issues when demand increased relatively soon after due to unprecedented government stimulus (Santacreu & Labelle, 2022). A particular example of this is the automotive industry. Fabs that were already running at capacity could quickly pivot the freed capacity to other orders (Lapedus, 2022a). While this was beneficial to the fabs in the short run, it also meant that little to no spare capacity was available when demand from automotive increased again. An added complication is that automotive chips are produced on 200mm wafers. 200mm fabs had been running at full capacity before the pandemic due to earlier plant closures (Lapedus, 2018).

More broadly, fab capacity could not have been increased in the short run to cover for the increased demand due to the pandemic, simply due to the nature of foundries. Constructing new foundries (‘fabs’) takes multiple years, provided WFE equipment is available (without shortages). I.e., in the case of ‘leading nodes’ (5nm on 300mm wafers), that means ASML has to ramp up EUV WFE production as they are the only producer of said machines. Lastly, because of the sheer cost of foundries, constructing them is a non-trivial choice. To illustrate shortages in short-term capacity concretely: TSMC, the largest foundry, reports running at >100% capacity, while 80% is typically considered ‘near full’ capacity (TSMC, 2021).

The underlying shortages

Though increased demand is the straw that broke the camel’s back, even if fab capacity could have been added, it could certainly not have been used. Other shortages had already occurred in the upstream supply chain at the current ‘stretched’ capacity. There are three key shortages resulting in overall short-term supply chain disruption: (1) silicon wafers, (2) photomask, and (3) ultra-pure water (UPW).

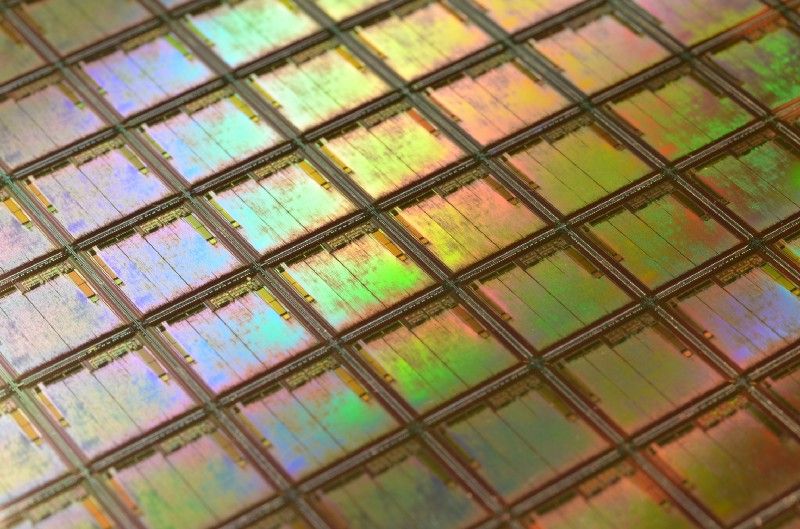

As touched on before, silicon wafers come in various sizes, with 200mm and 300mm being the most common now. Initially, 200mm was expected to decline, with fabs closing as the industry was moving to the newer 300mm size. 200mm peaked in 2007 before it saw increased demand due to specific applications for which it is more optimal than 300mm (Lapedus, 2018). Aside from fab capacity, 200mm wafer shortages are prevalent as well. Wafer suppliers are reluctant to invest in the ageing standard, even though demand remains strong. In general, demand exceeds supply in the 200mm wafer market, leading to shortages and increases in price, hampering growth (Lapedus, 2022a).

On the 300mm front, the situation is (even) worse. Where 200mm saw shortages, 300mm saw companies buy up many years of future supply already, which ensures shortages will continue in the future. Shin-Etsu and Sumco have separately stated that they expect 300mm shortages to continue, creating significant supply chain bottlenecks as wafers are the most basic requirements for semiconductor production (Chirgwin, 2022; Mochizuki & Savov, 2022).

Photomask is another key input of a ‘fab’. Essentially, photomask is used to create a “template” for EUV/DUV light to shine through, creating the patterns on the photoresist layer that later make up the patterns of silicon on the chip. Most notably, semiconductors cannot be produced without photomask, and photomask is specific to the type of light used, i.e., a different photomask is needed for EUV and DUV. Similar to the situation for silicon wafers, large investments have been made in the ‘future’ technology (EUV), with the capacity for the existing (‘mature’) DUV being neglected. Because tooling for the creation of photomasks is durable, tool manufacturers for 200mm DUV photomasks have either moved on to newer 300mm EUV photomask tools or have gone out of business due to the lack of demand (Lapedus, 2022b).

Once again, due to increased demand driven by the COVID-19 pandemic, demand for ‘mature’ nodes and their photomasks increased as well. However, without proper tooling, photomask makers are unable to meet demand, putting further restrictions on the expansion of 200mm/DUV fabrication.

Ultra-pure water (UPW) is water that does not contain any impurities, and it is used to clean electronics. It is estimated that to produce a single smartphone, over 13,000 litres of UPW are needed (Wishnick, 2021). TSMC was facing water shortages in 2021 as Taiwan was hit by a long-lasting drought. The firm had to order water by truck, greatly increasing costs and uncertainty (Scammell, 2021). Similar concerns have been raised after TSMC announced it would build fabs in Arizona, located in an area of the US where water shortages are already prevalent (Calma, 2021).

The root cause

It is interesting to note that these issues were not necessarily directly related to the COVID-19 pandemic. E.g., the pandemic did not directly disrupt wafer supply. Instead, increased demand seems to be the main driver that exacerbated existing shortages. There is, however, one more driver caused by the pandemic that has hit all industries, including semiconductors. Logistics. Worldwide shipping was disrupted on many occasions due to restrictions imposed by governments around the world. China, which is particularly important for raw materials for the semiconductor industry, saw up to 7% of freight unable to leave ports in 2021 (Accenture, n.d.; Vakil & Linton, 2021).

Concluding then, the semiconductor industry has been left largely unscathed by lockdowns and other restrictions due to its essential position in the modern-day economy. COVID-19 initially caused great economic uncertainty, leading to volatility in demand for semiconductors. Instead of a decrease in demand, industries soon realized consumer spending would, in fact, increase, partly due to behavioural changes and partly due to government intervention (stimulus). These demand increases resulted in increases in the demand for semiconductors. The key supply chain impact then does not lie in COVID-19 disrupting certain upstream supply chains, aside from some logistical issues, but in the exacerbation of existing shortages that the industry had been facing for years. Key shortages that we will observe going forward are those of silicon wafers, photomasks, and ultrapure water.

The future

Additionally, as firms invest in more ‘fab’ capacity, we will likely see shortages of ‘mature’ node silicon wafers (200mm) and 200mm tooling & DUV equipment as firms are unwilling to invest in 200mm wafer production. On the leading-edge node of 5nm, which uses EUV on 300mm wafers, we will likely see continued shortages of EUV equipment because of the monopoly by ASML on the market and the rapid investments into new EUV fabs that far exceed the historical pace. There is also an interplay between both shortages. When 200mm capacity is unavailable, firms will be incentivized to switch their production over to 300mm processes, further increasing the demand for new 300mm EUV fabs.

Companies active in the industry should focus on adding sustainable production capacity to once again operate at lower utilization levels. As we move forward, we will see sustained high demand for semiconductors, and even more so for important inputs such as silicon wafers and ultrapure water. Investments in new fabs for ‘mature’ nodes (200mm wafers) are inherently risky and should be made with caution, as many of the 200mm applications can be moved to 300mm. Lastly, for companies dependent on fab capacity (e.g., fabless chip companies), it becomes more and more important to obtain sufficient production capacity well in advance as shortages continue beyond the pandemic.

References

Accenture. (n.d.). Semiconductor Companies: Business Resilience in the Wake of COVID-19 A guide to the disruptive impacts & practical actions for semiconductor companies to take.

Calma, J. (2021, August 18). Water shortages loom over future semiconductor fabs in Arizona — The Verge. The Verge. https://www.theverge.com/22628925/water-semiconductor-shortage-arizona-drought

Chirgwin, R. (2022, February 10). Wafer woes could drag out chip shortage — Hardware — iTnews. Itnews.Com.Au. https://www.itnews.com.au/news/wafer-woes-could-drag-out-chip-shortage-575853

Lapedus, M. (2018). 200mm Fab Crunch. Semiconductor Engineering. https://semiengineering.com/200mm-fab-crunch/

Lapedus, M. (2022a). 200mm Shortages May Persist For Years. Semiconductor Engineering. https://semiengineering.com/200mm-shortages-may-persist-for-years/

Lapedus, M. (2022b, April 21). Photomask Shortages Grow At Mature Nodes. Semiconductor Engineering. https://semiengineering.com/photomask-shortages-grow-at-mature-nodes/

Mochizuki, T., & Savov, V. (2022, February 9). Chip Shortage: Key Supplier of Silicon Wafers Says It’s Sold Out Through 2026 — Bloomberg. Bloomberg. https://www.bloomberg.com/news/articles/2022-02-09/key-supplier-of-wafers-for-chips-says-it-s-sold-out-through-2026

Santacreu, A. M., & Labelle, J. (2022). Global Supply Chain Disruptions and Inflation During the COVID-19 Pandemic. Federal Reserve Bank of St. Louis Review, 1–14.

Scammell, R. (2021, May 19). Taiwan drought threatens water supply to major semiconductor fabs | Verdict. https://www.verdict.co.uk/taiwan-drought-chip-supply/

Stewart, D., & Crossan, G. (2022, February 17). Consumer electronics sales growth | Deloitte Insights. Deloitte Insights. https://www2.deloitte.com/xe/en/insights/industry/technology/consumer-electronics-sales-growth-covid-19.html

TSMC. (2021, April 9). TSMC March 2021 Revenue Report. TSMC.Com. https://pr.tsmc.com/system/files/newspdf/attachment/2f21e07c918e01164cb261dfbdc5ace5703a43d3/Mar 2021 %28E%29_final.pdf

Vakil, B., & Linton, T. (2021, February 26). Why We’re in the Midst of a Global Semiconductor Shortage. Harvard Business Review. https://hbr.org/2021/02/why-were-in-the-midst-of-a-global-semiconductor-shortage

Warneke, S., Schulte, M., & Ruester, F. (2021). The New Tech Savvy. Oliver Wyman.

Wishnick, E. (2021, August 13). Water With Your Chips? Semiconductors and Water Scarcity in China — The Diplomat. The Diplomat. https://thediplomat.com/2021/08/water-with-your-chips-semiconductors-and-water-scarcity-in-china/